Last year I was featured in a Grow by Acorns article that highlighted millennials saving half their income. Over the course of 2017, I created and (mostly) stuck to my monthly budget. There were times that I would overspend if I went on vacations or had to replenish my emergency fund. But at the end of the year, I hadn’t saved as much as I had hoped. If I’m being honest, I didn’t save exactly half. Don’t get me wrong, I was very close (40%) but didn’t quite reach that 50% mark. That was a disappointing realization, here I am preaching about saving half your income, and I didn’t quite do it myself.

As with anything, saving money takes time and practice. We don’t always hit a bullseye with the first dart. When we stop, take a breath, and reflect, that’s when we start to grow. This year in an effort to grow, I’m creating and sticking to not just one budget…I’m holding myself accountable to three budgets.

1. My Monthly Budget

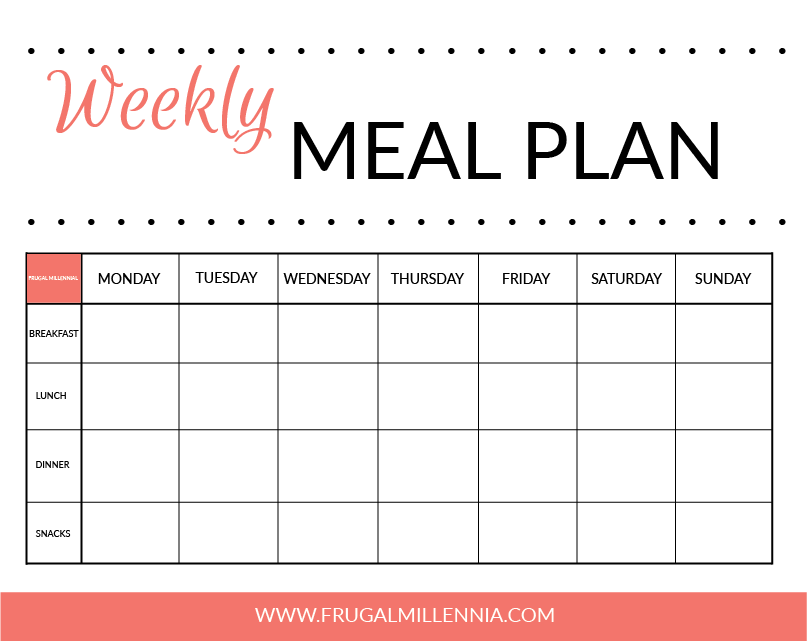

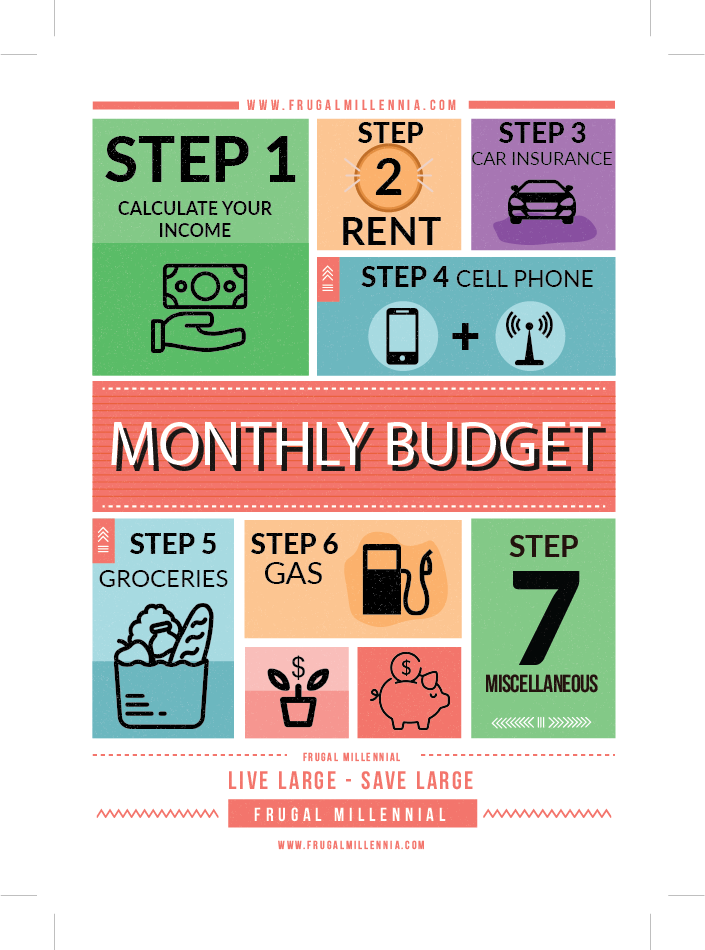

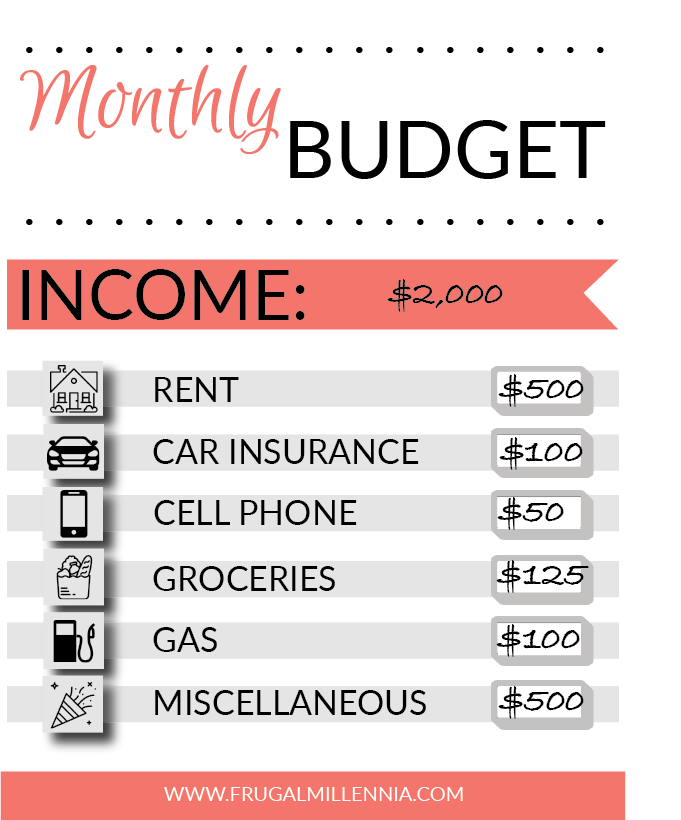

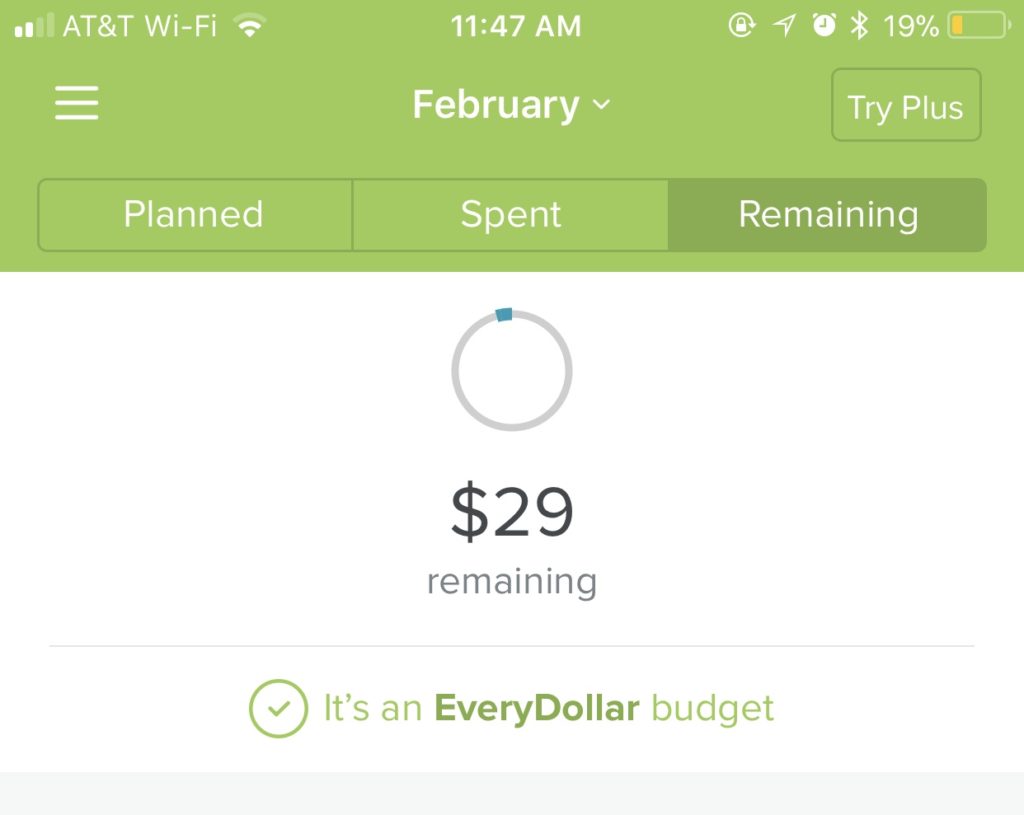

A budget is a written plan for your money. As Dave Ramsey says, “A budget is telling your money where to go instead of wondering where it went.” In order to succeed with money, you need to tell your money where to go every month, not the other way around. If you don’t spend your money intentionally, you aren’t going to be able to save half your income. I’ve talked extensively about how I create a monthly budget, check out my 7 category budget to see how I divvy up my monthly expenses.

This year, I am being more intentional about not going over my monthly budget. There were many months that I would spend a majority of my miscellaneous money within the first two weeks of the month. That made for some tough choices. Would I say no to all social events the second half of the month? Or, would I overspend by a few hundred dollars to make up the difference? I was stuck between a rock and a hard place.

We’re almost 3 months (25%) into 2018 and so far I can say with complete confidence, that I have stuck with my monthly budget each month so far. Part of that is because I have been more diligent about planning out my spending to make my miscellaneous budget stretch throughout the entire month. The other part is because I have created and utilized new budget categories. (See below)

2. Travel Budget

One thing that I’ve learned over the years is that life is all about balance. A big part of saving money is getting comfortable saying no. Over the past 4 years, I’ve said no to a lot of things. I’ve missed brunches, nights out with friends, and even trips with friends because I was so focused on getting out of debt and saving for my future. Last year I realized I needed to start saying yes. I was turning 25 and had spent most of my time in my 20s saying no. I didn’t want to look back on this decade and think, “man, I wish I had just lived a little.” Thus, the idea of the “year of fun” was born. So, I decided I was going to try and find a better balance between saving money and having fun.

Boy did I knock this goal out of the park–2017 was definitely a year to remember. I went to Cancun to swim with whale sharks, caught a 7-foot fish deep sea fishing, met Major Lazer in Las Vegas, and had the best 25th birthday surrounded by friends and family in San Diego. I can easily say, hands down that 2017 was a year of fun.

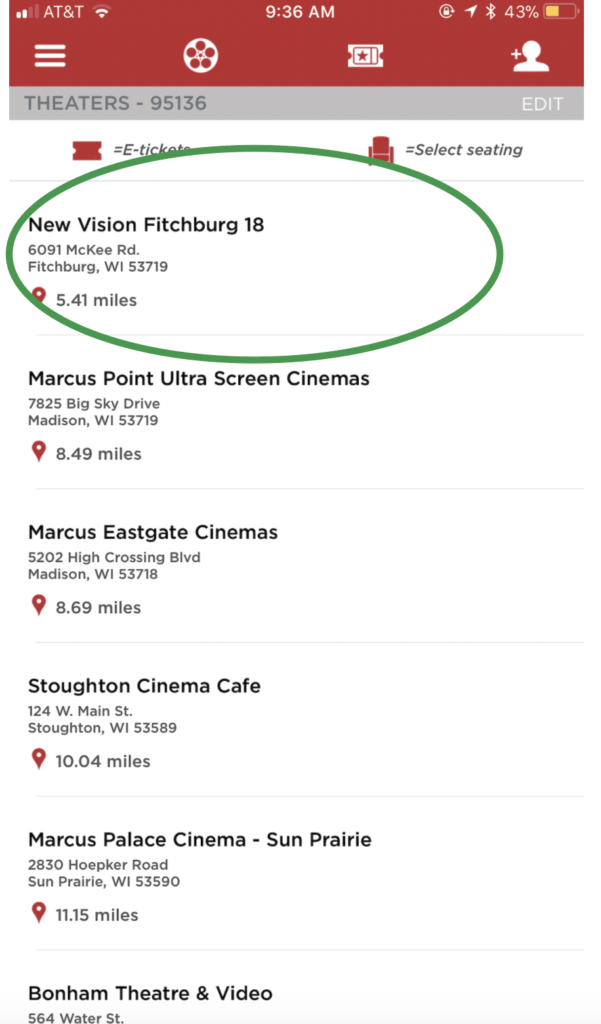

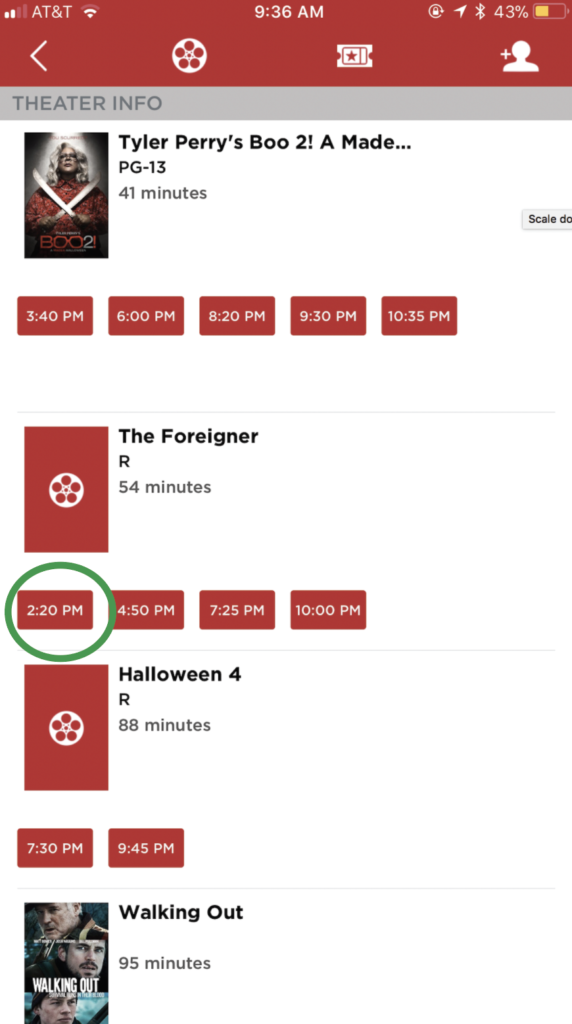

My 2018 Travel Budget

As with everything, that fun came at a cost. While I wouldn’t trade any of my amazing vacations for anything, I do wish I would have budgeted for them accordingly. Because I was so used to saying no to trips with friend and family the thought to create an annual travel budget had never crossed my mind. This year, I’ve decided to set aside $3,000 in a travel budget. I can do anything I want with that money. I can spend it on day trips, or a luxury vacation on the other side of the world. Every time I spend money on a plane ticket or hotel room, I deduct it from my travel budget. While I’m giving myself a lot of flexibility here, one thing’s for sure: once the money is gone, it’s gone.

3. Additional Miscellaneous Budget

Another area that would often cause me to overspend was gifts and unexpected expenses. As I type this, I’m cringing that I didn’t think about it earlier, but things are going to happen. Last year, I had some pretty heavy car expenses due to freak accidents. On one occasion my car flooded–I got into my car after work one rainy Tuesday evening to find a 2-inch puddle of water on the floor of my car. After an initial freak out moment, I calmly called my insurance company and fortunately, I only had to pay a $500 deductible, but the total damage was over $3,000!

On another occasion, I was stopping by the grocery store on my way home from work and after I came out, I found my car window had been smashed and my new MacBook gone. This time, my car insurance wasn’t able to cover that incident and that was a very hard (and expensive) lesson to learn. Not to self: never leave anything valuable in the car, even if it is hidden.

Extra Padding

Budgeting is a lot like dieting. It takes discipline and hard work, especially in a world full of temptations. Last year, some of my budgeting setbacks would cause me to temporarily throw in the towel. After all, if I’m going to not keep my budget this month, why not just buy a new outfit while I’m at it. I’m learning to give myself more flexibility to make mistakes and not let them set me back.

Because I didn’t have a freak accident cushion built into my budget, I just had to swallow those expenses. This year, I’ve built an extra $1,500 cushion into my budget. That way, when things happen, like freak accidents, or if I happen to go over my budget one or two months out of the year, I have it covered. An added expense doesn’t need to trigger me to go off the deep end. Having extra padding in my budget that I can dip into in times of need, has given me peace of mind.

Budgeting for Success

I used to think budgeting was black and white. And in some respect I still do. But if there’s one thing 2017 taught me it’s that life is many different shades of gray. Unexpected things happen, that’s life. You can’t always control what is going to happen to you on any given day. Some days life gives you lemons and other days you just have to roll with the punches. By allowing myself more flexibility with my budget I am less stressed and am more on track to reach my goals this year.

Stay Frugal. Stay Fiesty.