If you want to get ahead and accomplish your #financialgoals, you need a monthly budget. Most Millennials graduate college with a fancy college degree but no idea how to manage money. The first step to tackling your finances is to create a monthly budget. I get it, you hear the word budget and you want to run for the hills. Most people cringe when they hear that dreaded b-word. But just hear me out, budgeting doesn’t have to be boring, overwhelming, or confusing.

I’ve been studying budgeting for the last 5 years, I’ve read over 50 books on the subject (can you even believe there are that many books out there?!). And I think I have a pretty good idea of what all of the major financial experts have to say about budgeting. But in all of my research, I keep coming across the same issue. The way budgeting is presented is complicated! Most people suggest using percentages and ratios, lots of spending categories, and that gets overwhelming.

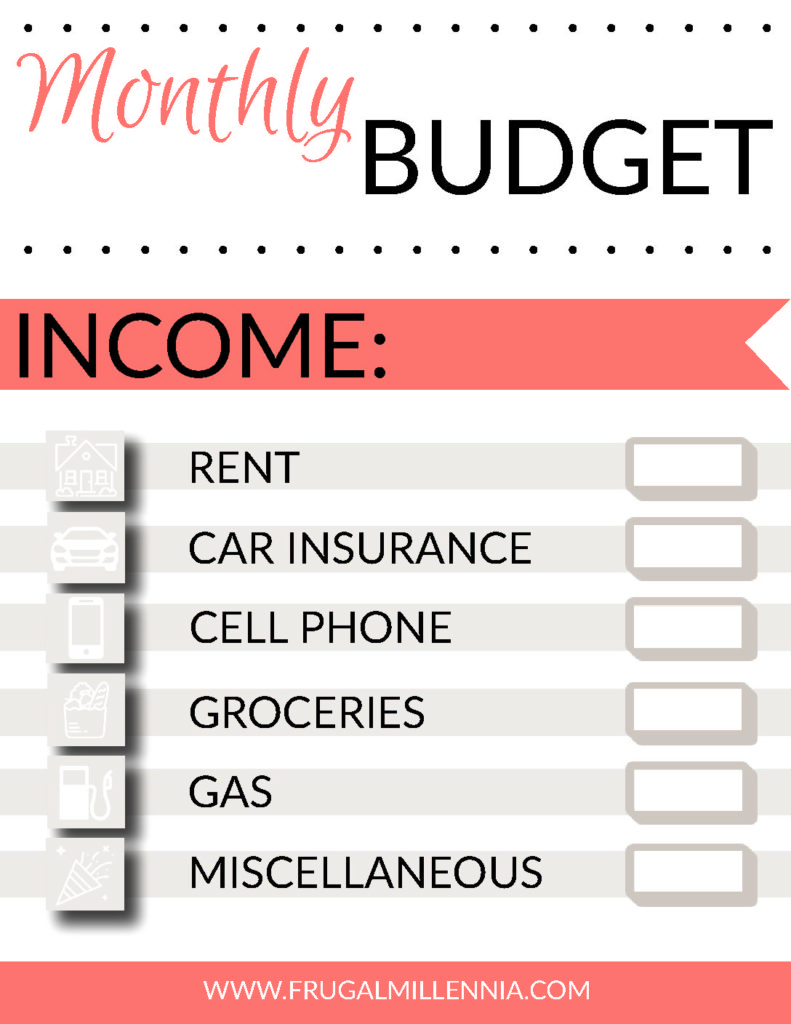

Worry not, my fellow frugal millennials! Over the past 5 years, I’ve learned a few things to take the drudgery out of budgeting. First things first, download and print your own budgeting worksheet.

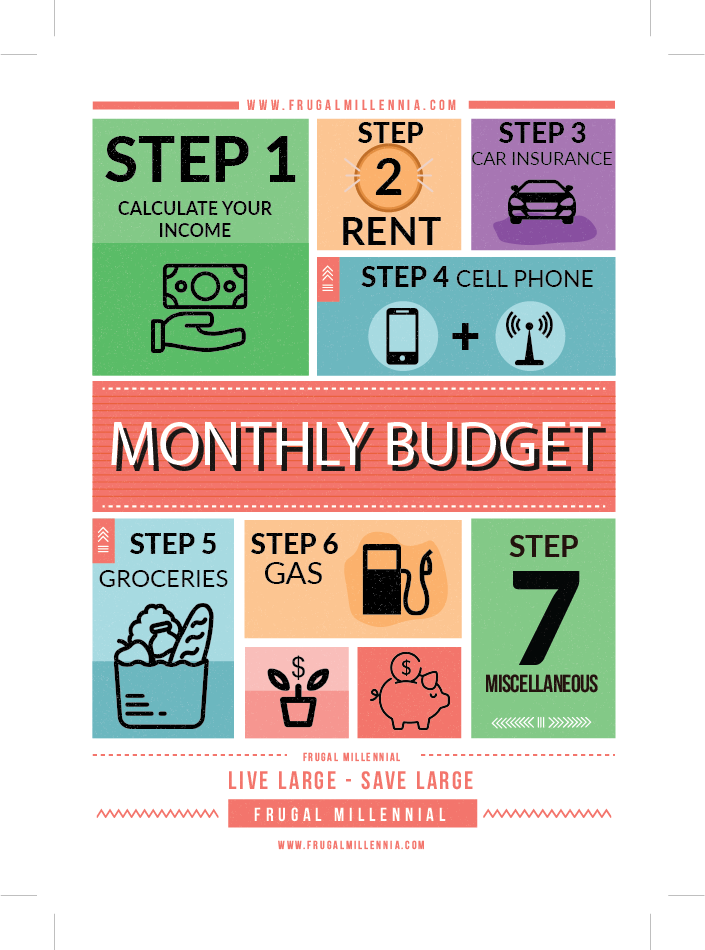

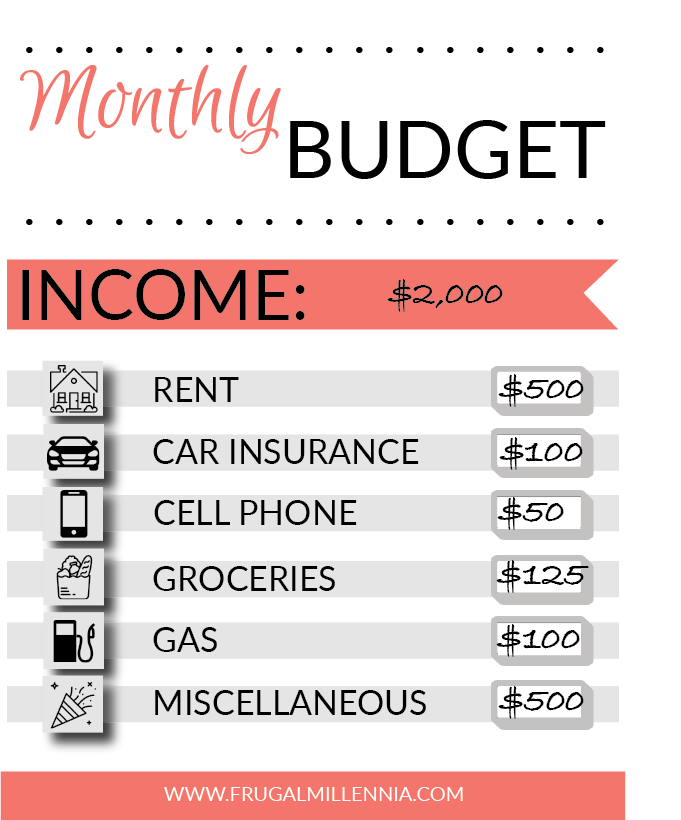

Step 1: Calculate Your Income

Before you can even begin to think about how much you can spend, you need to figure out how much you make. This isn’t complicated. Since it’s 2017 I’m assuming your employer pays you via direct deposit. Log into your bank account and see how much your employer deposits into your account each pay period. Then, figure out how often your employer pays you. Are you paid weekly, monthly, bi-weekly, or bi-monthly?

Let’s say you take home $1,000 on the 15th and 30th every month. In total, you take home $2,000 every month. That was easy! Now that we know how much money you are bringing in each month, let’s figure out how much we should spend.

Step 2: Calculate Your Rent

For most of us Millennials, our rent is a fixed rate and you’ve probably signed a year-long lease. While most financial experts recommend spending 25%-33% of your take-home pay on rent, you’re probably already stuck in a lease for the next several months. So, while your rent should be somewhere between $500-$660 per month (using our $2,000/month take-home pay example), you may be spending more than that.

Step 2.1: Budgeting Utilities

If you’re lucky, your utilities may be included in the cost of your rent. This makes it easy for you to plan ahead and know exactly how much you’re spending each month. If you’re not as lucky, and you are responsible for your varying utility costs, you’re going to have to take a few extra steps.

Electric, Gas, Water & Sewage

Look at your electric, gas, water & sewage bills over the past year, this should be as easy as logging into your online account and looking at your payment history. Calculate your average monthly spend and put that into your budget. This cost shouldn’t vary too much from month to month, but know that depending on your consumption habits you may be a few dollars over or under each month.

In your budget worksheet, fill out how much you spend on rent, and if applicable, add that to your average utility spend per month. In our example, let’s say you pay $500 per month for your apartment and all of your utilities are included. Go you!

Step 3: Budget Your Car Insurance

If you drive a car you need car insurance. This isn’t just me going on a rant encouraging you to get insurance (side note: you also NEED health insurance to protect yourself from bankruptcy). Most state laws require you to have car insurance if you drive your car. If you’re pulled over by the police and don’t have car insurance you better bet you’re going to get slapped with a major ticket. Save yourself the ticket and headache and make sure you are insured.

Your car insurance should be a fixed monthly rate that you pay every month.

In your budget worksheet, fill out how much you spend on car insurance each month. For our example, let’s say you pay $100 per month on car insurance.

Step 4: Budget for Your Cell Phone

I’m going to go ahead and assume that we all have a cell phone, and most of us have fancy data plans to go with them. The most affordable way to use your cell phone is to stay on a family plan for as long as possible. With a family plan, the cost is much less than if you were to get your own individual plan. In fact, what you would pay on a family plan is often half of what you would pay on an individual plan.

Calculate what you pay for the actual phone (if you’re leasing the phone through your carrier). And calculate what you pay to use the phone every month. Add that up and put it on your budget worksheet. In our example, let’s say you pay $30 per month to lease your iPhone plus $20 per month to stay on your family’s cell phone plan.

Step 5: Budget for Groceries

Your grocery category is one category where you can really save a lot of money. Most people spend way too much on groceries that they end up throwing away. The key to saving money on groceries is to go into the store with a plan and stick to that plan! If you’re a single person, shopping for yourself, I recommend spending between $125-$150 per month on groceries. That breaks down to $31-$37 per week on groceries.

Check out my post on how I grocery shop on a budget for more details on how to slash your grocery bill. Then, fill out the grocery section of your budget worksheet.

Step 6: Budget for Gas

If you own a car, you probably need to fill it up with gas every once and a while. Calculating how much you spend on gas every month isn’t too hard. Figure out how often you fill up with gas, and what your average spend is. I fill my car up with gas every 2 weeks. Each time I spend around $40. I give myself a bit of a cushion and allow my gas budget to be $100 per month. That extra padding helps if I take a road trip or if gas prices end up skyrocketing–which they sometimes do in California!

Calculate your gas budget and add it to the gas portion of your budget worksheet.

Step 6.1: Budgeting Parking

If you have to pay for a monthly parking pass for your apartment complex or work you’ll need to add this into your budget. If you only pay for parking every once and a while when you go to events, you can include that expense in your “miscellaneous” category.

For our example, let’s say you also budget $100 per month on gas and don’t’ have to pay for a monthly parking pass.

Step 7: The Miscellaneous Category

The miscellaneous category of my budget is my favorite and soon it will be your new favorite, too! I put all of my other monthly expenses in my miscellaneous category. This includes going out to eat, getting my hair/nails done, buying clothes, toiletries, etc. Some financial experts will tell you that it’s better to break your miscellaneous category into smaller, more manageable categories. If that works better for you, then by all means breakup your miscellaneous category.

Keeping One General Miscellaneous Category

For me, keeping one large, general category has really helped me stay on track and spend less. When I first started budgeting regularly about 5 years ago I split my budget into many little categories. But I found that I was overwhelmed as to how much money I should put in each category. And what about expenses that occurred frequently but not every month, like getting my nails done or buying shampoo? Ultimately having so many categories caused me to spend way more than I do now and it took me a lot longer to create the budget at the beginning of each month.

And thus, the general Miscellaneous Category was created.

Budgeting for Miscellaneous

You can decide how much you want to spend on miscellaneous items every month. To give you a point of reference, I budget $500 per month in my Miscellaneous Category. I break that down into $100 weekly increments and give myself that extra $100 to splurge on a random shopping trip, day trip, or an afternoon at the salon.

For the most part, I try to save my $100 for the weekend. I know that by the time Friday night hits, I’m going to want to grab a drink with my friends, head to a movie, or grab a meal out. Realistically, $100 is enough for a few budget-friendly weekend activities or one extravagant experience.

There was a time when I was going out to lunch and happy hour during the week and found that I was spending my weekly miscellaneous budget during the work-week. By the time the weekend rolled around, I had no money left to spend. I was either really cranky from being a shut-in. Or, more often than not, I was spending $800 per month on miscellaneous items.

Decide how much you want to spend on miscellaneous items each month. Add that amount to your budget worksheet.

Tying Your Budget Together

Once you’ve determined how much you’re going to budget for each category, you need to start tracking your expenses. Tracking your expenses is going to be the key to your success. If you don’t’ track your expenses, how do you know how much you’re spending? You don’t. And odds are, you’re going to end up overspending.

There are 2 apps I like to use: Mint and EveryDollar. Personally, I use EveryDollar more than Mint. I’m just more accustomed to EveryDollar than I am to Mint. Both apps are equally as good.

You’ll notice my budgeting method is pretty simple and straightforward. In a nutshell, I try and spend as little as possible so that I can save at least half of my income. In the example above, we end up spending $1,375 of our $2,000 take-home pay. That means we end up saving about 1/3 of our take-home pay or $625 every month. That is a great start! You could put that $625 to work, either to pay off debt or invest in retirement.

You’ll also notice, I didn’t add that $625 to a new category on the budget. There’s a reason for this: out of sight, out of mind. For me, if I see that amount printed on my budget, I know I would be tempted to spend it. Instead, I set up autopay to either pay off debt or invest in retirement. Trust me, if you forget it’s even there, you’ll end up saving a lot more.

Comment below with questions, and happy budgeting!