The other day I was taking a look at my retirement accounts and was shocked at what I had found. The amount of money I had in my retirement accounts was way more than what I had originally invested. This got me to thinking about the power of compound interest and why it is so important for Millennials. If you work hard to invest when you’re in your early 20s, the payback will be tenfold.

Simple Interest

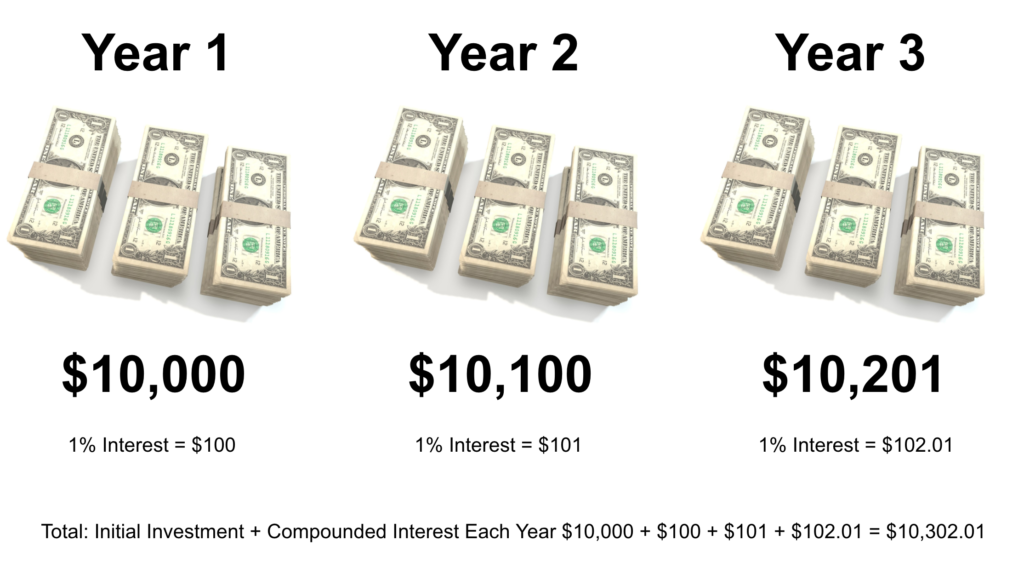

To understand compound interest you must first understand simple interest. Let me give you an example of simple interest to help me explain.

Let’s say you deposit $10,000 into a savings account. First of all, good for you! You’ve worked hard and saved $10,000, that’s a big step right there! If you chose a credit union or online bank, like Ally, you are probably earning 1% interest on that account each year. That means every year your $10,000 will earn 1% or $100. After 3 years your initial $10,000 investment has turned into $10,300. Pretty good, right? Let’s take a look at what would happen if you had invested that $10,000 into a mutual fund with compound interest.

Compound Interest

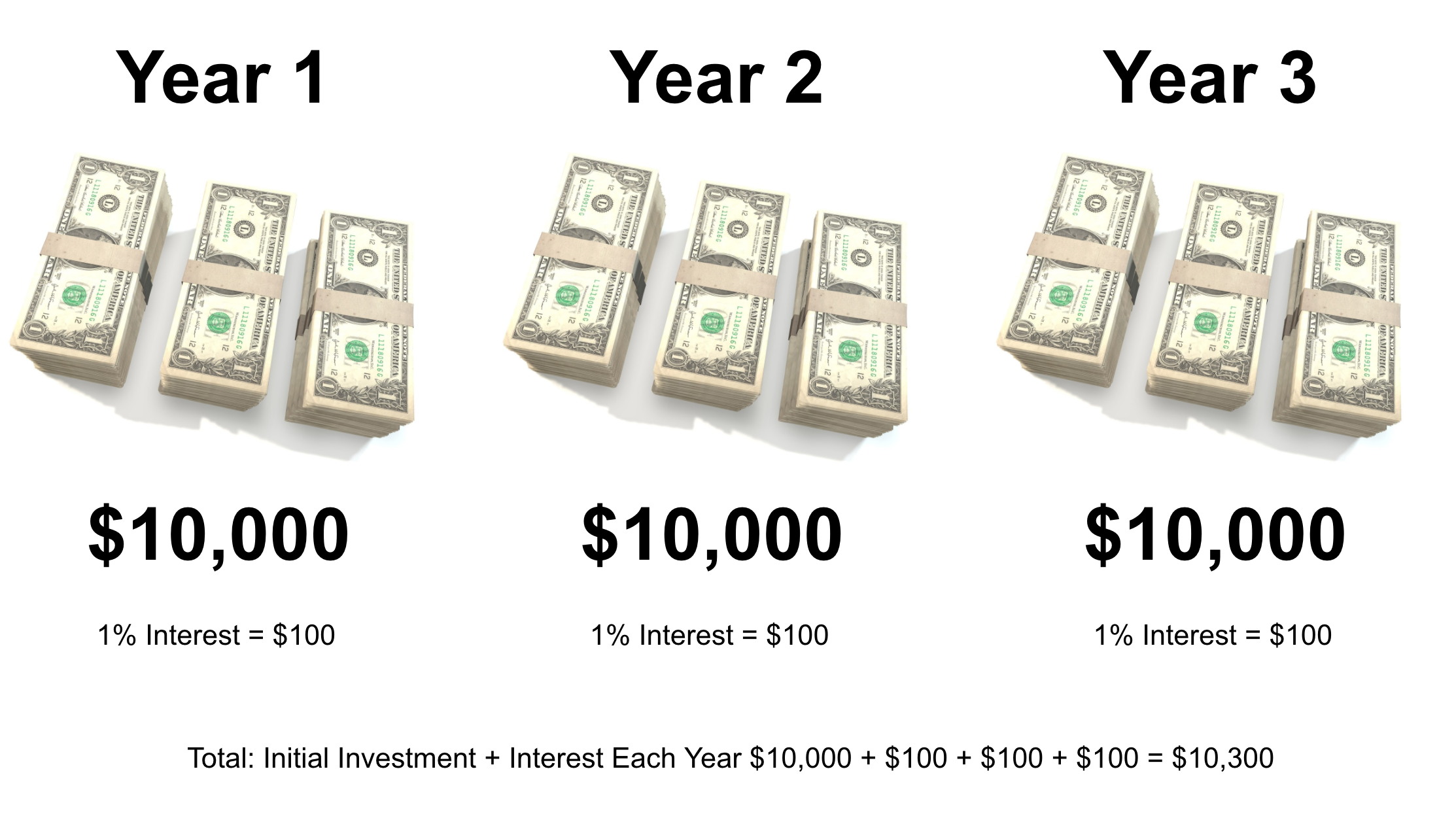

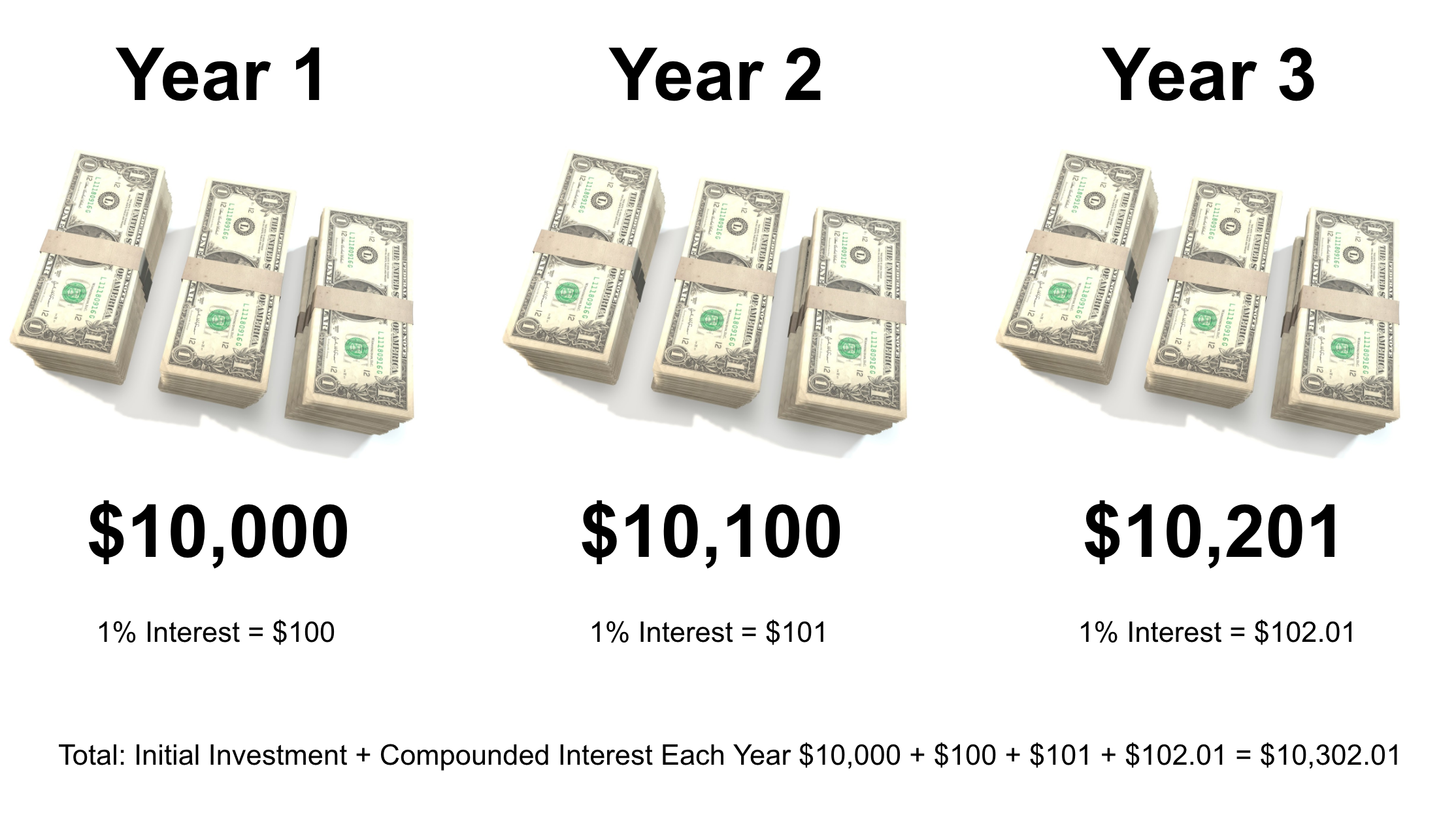

Compound interest is the interest an investor earns on her original investment plus all the interest earned on the interest that has accumulated over time. Woah! What does that even mean? You can think of compound interest as interest on interest. It creates a mathematical explosion.

Let’s say you take your same $10,000 investment and instead of parking it in a bank you decide it into a low performing mutual fund that earns 1% interest compounded annually. Side note: most mutual finds earn way more than 1%. In fact, you have to look really hard to find such a low performing mutual fund. I digress…You still earn 1% interest but that interest is compounded annually. How does that change your total at the end of 3 years?

How Compound Interest Affects Retirement

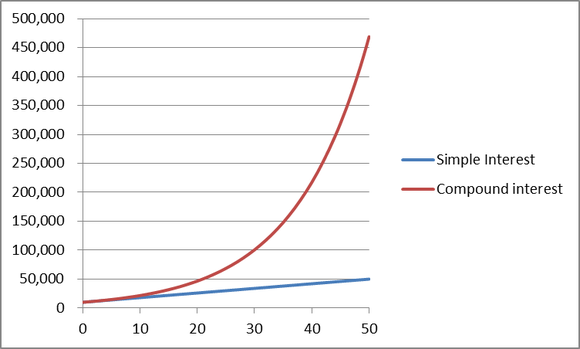

The longer your money has the opportunity to compound, the greater the effect will be. If you start contributing to your retirement at the age of 25 keep that money invested until the age of 65 you will be blown away at the results.

Simple Interest and Retirement

Let’s say on your 25th birthday your parents gift you $10,000. My, what generous parents you have! You decide to plop that $10,000 gift into an account that earns 10% interest. Unfortunately, you didn’t do your research and the interest isn’t compounded, womp womp. After 40 years you decide to take a look at that account to see the value of your investment. Your initial $10,000 investment has turned into $50,000. That’s a pretty nice birthday gift, mom and dad.

Compound Interest and Retirement

But what would happen if you invested that $10,000 gift into an account with compound interest? Good question, I’m glad you asked! Let’s take the $10,000 your parents gave you and invest it into an account with compound interest. Hold on tight, I promise you will be blown away by the results. Your original $10,000 investment at the age of 25 will have turned into $452,592.56 by the time you are 65.

That is the magic of compound interest, my friends. Even if you never invested another penny into your retirement account you will still retire with nearly half a million dollars. You did nothing except leave that money in a well-chosen account. You never touched the money for 40 years and it has rewarded you by growing exponentially.

The Importance of Investing Consistently

If you have a large pile of cash laying around or you have generous parents who are able to gift you large piles of money, the example above is perfect for you. You are fortunate enough to take your large sum of money, put it in a good investment account and watch it grow.

The rest of us need to invest consistently. If you invest $200 per month between the age of 25 and 65 you will retire a millionaire. You read that right. If you invest $200 per month over the course of 40 years, you will end up with $1.16 million dollars.

Don’t Have Extra Money to Invest?

If you’re strapped for cash and don’t have an extra $200 per month lying around, let’s take a step back. In fact, let’s break down the numbers. $200 per month is $6.67 a day. How often do you go out to lunch? Do you stop by Starbucks every day? What about Happy Hour, how many days a week do you meet your friends for half priced drinks and appetizers? Somewhere in your budget, you can find a place to squeeze $6.67 a day into your retirement account.

If you’re looking for a way to invest $200 per month into your retirement account and just can’t find a way to make the numbers work, adjust your budget. I use a 7 category budget to help me stay on track. By using tools like Mint and EveryDollar, I am able to easily track my spending and keep it in check.