The other day I was talking finances with a childhood friend. We love geeking out to our finances and putting on our nerd glasses. She was telling me that while she has paid off a ton of debt over the last year it’s been a struggle to find the motivation each month to continue making payments.

This got me thinking. Why is it that we can make good financial decisions day after day and month after month but that it gets harder and harder to find the motivation to continue making them?

I think the answer lies in the fact that we don’t always look at the big picture. When we get so focused on saving extra pennies and investing a few hundred dollars here or there it can be easy to feel like we’re missing out on life. Instead of focusing on the big picture like becoming debt-free or retiring early, or paying cash for a luxurious vacation we tend to focus on the day-to-day monotony of being frugal. It can be so easy to get bogged down by frugality, after all, it doesn’t have the best connotation. But in order to stay on the frugal course, we need to have the bigger picture, the bigger goal in mind.

When my friend said to me that although she sometimes feels like she’s not doing enough day-to-day when she looks at how much debt she’s been able to pay off over the last year it amazes her. It amazed me too. When I look at my own finances, making frugal decisions has been challenging for me lately. But when I look what I’ve accomplished over the last few years I’m quite proud of what I’ve been able to do.

My challenge to all of my fellow frugal millennials out there who have been struggling to say the course is to really think about the reason you saving and investing. Have your goal in mind as you continue to make the right (but sometimes difficult) decisions.

Stay Frugal. Stay Feisty.

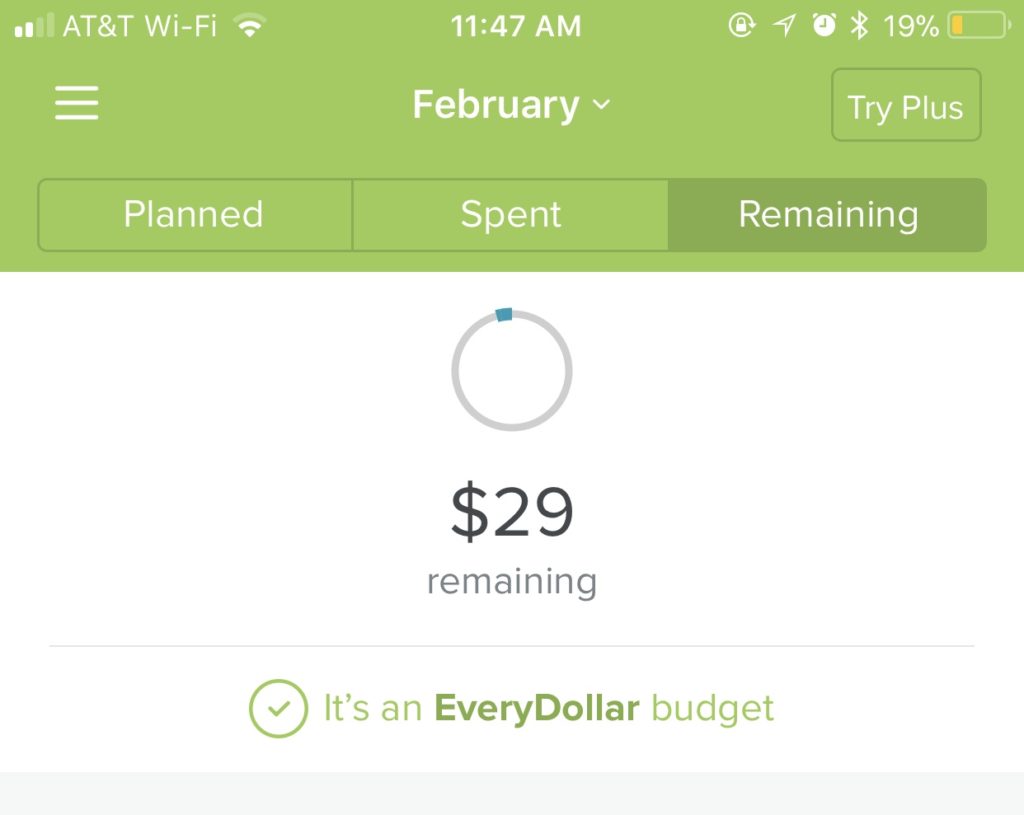

But hear me out. There are a number of stores that I personally avoid just because I know I’m going to overspend. Every time I walk into a Target I don’t come out with just one thing. I come out with an entire cart of things. And just like that my budget is just blown. In one hour I can easily blow my entire spending budget for the week.

But hear me out. There are a number of stores that I personally avoid just because I know I’m going to overspend. Every time I walk into a Target I don’t come out with just one thing. I come out with an entire cart of things. And just like that my budget is just blown. In one hour I can easily blow my entire spending budget for the week.