When you think of the word “Millionaire” what comes to mind? Oceanfront mansions, Lamborghinis, personal jets, and a life of luxury? If those things scream Millionaire to you, you’re not alone. In fact, often times when I think of Millionaires I think of celebrities vacationing on private islands and shopping on Rodeo Drive. Recently, my eyes have been opened to the fact that anyone can become a millionaire. You don’t need a six or seven figure salary to join the Millionaire’s club. You can take steps today to prepare your bank account for a nice pile of cash.

The Millionaire Next Door

If you haven’t read Thomas J. Stanley’s, Millionaire Next Door, you have to check it out. I highly recommend renting a copy for free from your Public Library. But if you prefer your own copy, you can grab it from Amazon, too. A few decades ago Stanley and his colleague, William D. Danko, studied the habits of hundreds of millionaires (people with a net worth of at least 1 million dollars). Their findings will likely shock you. Almost everything they found is counterintuitive to what you and I think when we hear the word Millionaire. If you want to become a Millionaire, keep reading.

Top 5 Millionaire Habits

During their multi-year study, Stanley and Danko discovered several millionaire habits. Surprisingly, a large number of Millionaires have a modest salary. Having a high salary isn’t an indicator that you will become a Millionaire, having self-control and developing good habits are bigger indicators of whether or not you will become a Millionaire.

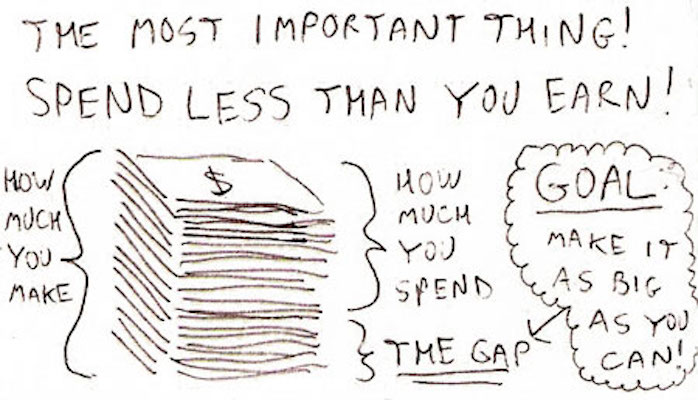

Millionaire Habit #1: Spend Less than You Earn

This first Millionaire Habit is obvious. Of course, you have to spend less than you earn if you want to build wealth! But the fact of the matter is, 60% of Americans consistently spend more than they earn. Don’t believe me? Take a look at one of the richest men in America, Warren Buffett. Known for his love of McDonald’s, Buffett splurges, only when the stock market is doing well. What’s a typical splurge for Buffett? Spending $3.17 on breakfast at McDonald’s on a bacon, egg and cheese biscuit sandwich.

The first step to living off less than you make is to create a budget. A budget is a great way to guide your spending. Creating a budget doesn’t have to be difficult. In fact, once you create your budget you can easily replicate it month after month. To start your budget preparation, begin tracking your monthly expenses, this will give you a baseline for how much you are spending on food, entertainment, and miscellaneous.

Check out my Foolproof 8 Category Budget for more budgeting essentials.

Millionaire Habit #2: Buy Used

One of my guilty pleasures is watching Reality TV. There I said it. I am a recovering Reality TV addict. One of my favorite TV shows used to be 19 Kids and Counting. You may have heard of the Duggar Family, they’re known for their Conservative Christian values and brood of 19 children. While I don’t agree with everything they believe in, they do have a great saying “buy used and save the difference”. Buying something used saves you money in the short and long term

If you are morally against buying used clothes or furniture, I get it. But one area of your life that you should ALWAYS buy used is you car. Cars depreciate 20% the second you drive it off the lot. So that $20,000 new Toyota you just bought is only worth $16,000 the second you drive it off the lot. Ouch! Depreciating $4,000 hurts. The average new car payment in America is just under $500 per month. To throw away money at an item that depreciates in value is insane! Most Millionaires see right past the shiny exteriors and updated navigation systems of new BMWs and opt for a more economically sound used Toyota or Honda.

Check out: How to Drive Free cars for LIFE!

Millionaire Habit #3: Choose a Modest Home

Three times more Millionaires live in homes valued at less than $300,000 than more than $1 million. Why do Millionaires live in modest homes? Housing or rent is going to be the biggest expense in your budget, accounting for 25-30% of the money you spend every month. So, the more expensive your home, the more money you will spend every month to pay for that home. Big houses come with big mortgages, big utility bills, and even more property taxes. The more money you spend every month on your home, the less money you can save and invest every month.

Most Millionaires live in modest homes that they’ve owned for decades. Take the richest man in Mexico, Carlos Slim Helú, he’s lived in the same 6 bedroom house that he’s owned for the past 30 years.

Millionaire Habit #4: Stop Keeping Up with the Joneses

You know the Joneses, they’re the people who always seem to have the newest car, newest iPhone, coolest vacation. Stop trying to one-up them. One thing you’ll never know about the Joneses is how they paid for their luxury items. For all you know, the Joneses are in debt up to their eyeballs and have no savings or investment accounts. When you try to keep up with the Joneses you overspend. The comparison trap is real. It’s easy to get sucked into having the latest and greatest and showing it off. But remember, the more you spend on things the less you spend on long-term investments.

The Everyday Millionaire knows how destructive keeping up with the Joneses can be. That’s why they mind their own business. Millionaires create a monthly budget and stick to it. They don’t care what others think about them and they aren’t in the business of showing off. The Everyday Millionaire knows that having a full bank account is going to give him more happiness and fulfillment than the latest and greatest iPhone.

Millionaire Habit #5: Pay Yourself First

I’ve saved the best for last. The #1 Millionaire Habit is to pay yourself first. What do I mean by that? Most people say they don’t save enough money for retirement, invest enough, or have a big enough emergency fund, because they don’t have the money to save more. That’s why most Millionaires pay into those accounts FIRST. They treat saving like a bill.

When you pay yourself first you prevent your future self from buying a round of drinks for your coworkers at the next Happy Hour event. If you’re worried that you won’t have enough money to pay the rest of your bills, worry not! Research shows that when people pay themselves first they are more likely to find ways to meet the rest of their expenses. You’ll be more motivated to find a side hustle, sell unused items, or trim the fat off your budget.

Millionaire Habits Summarized

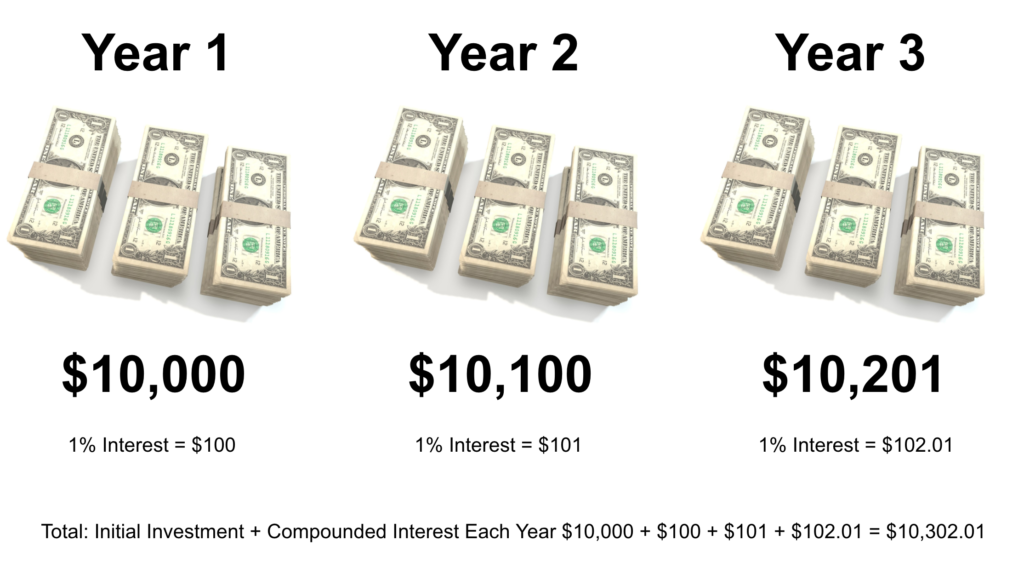

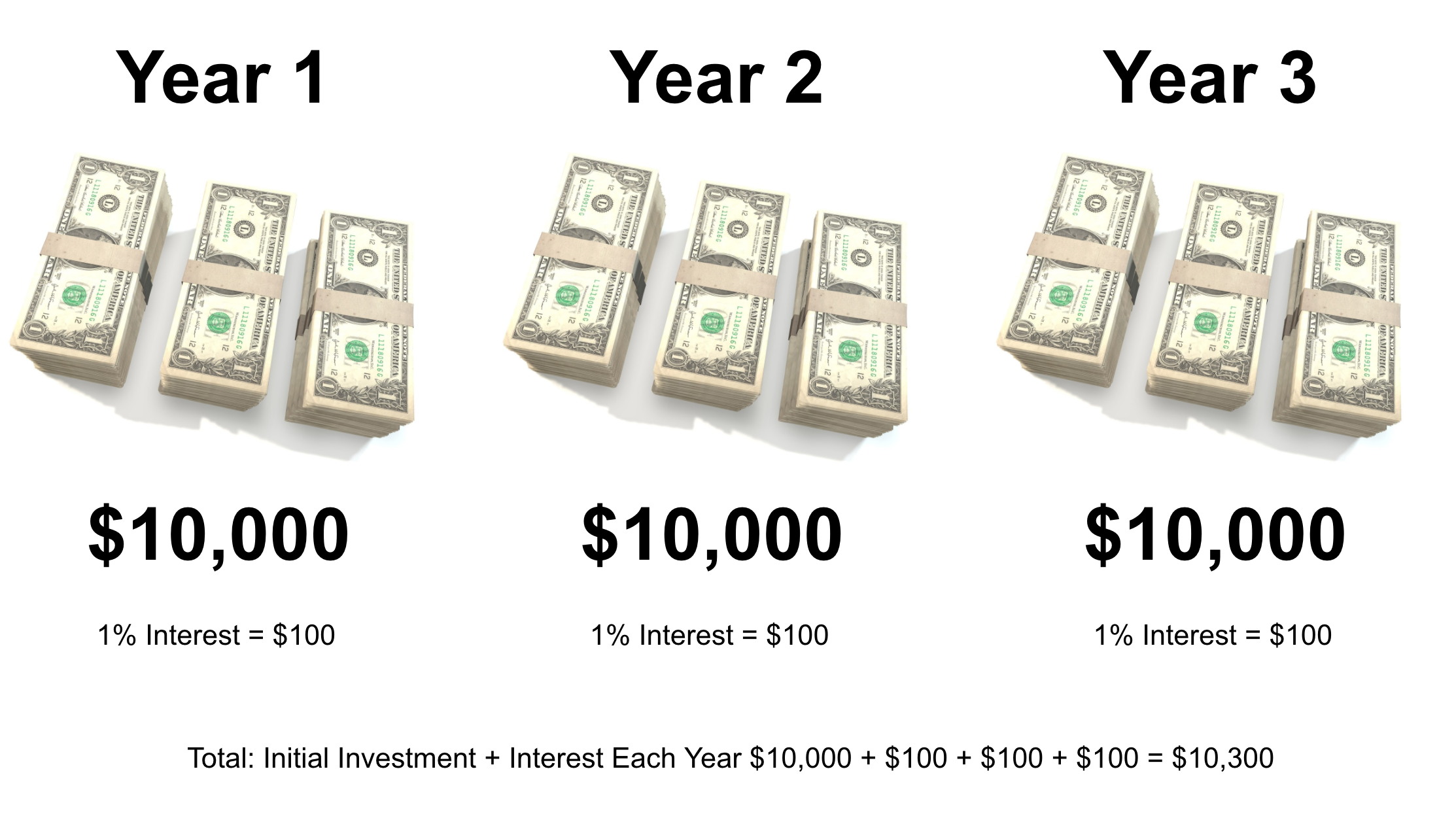

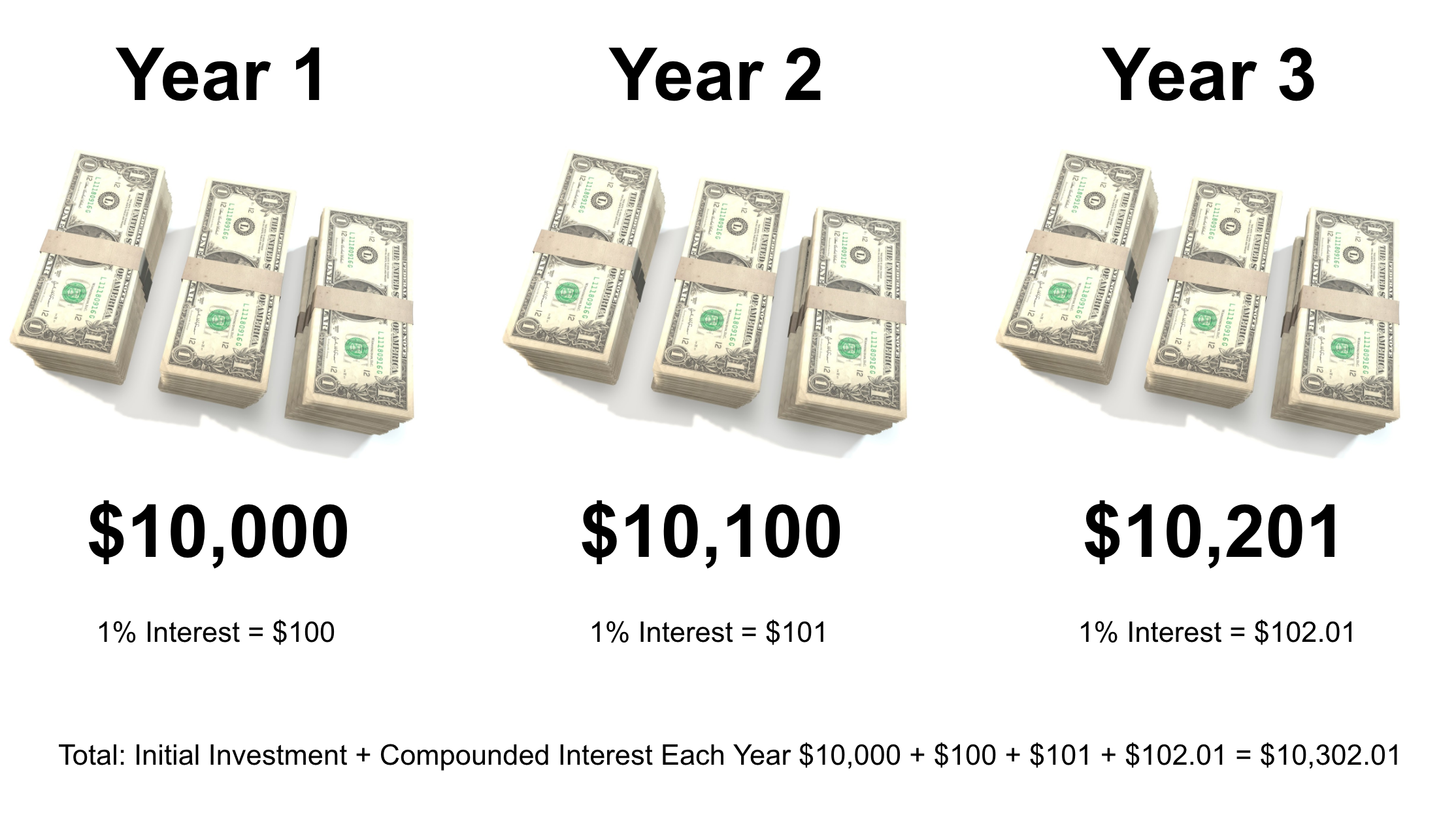

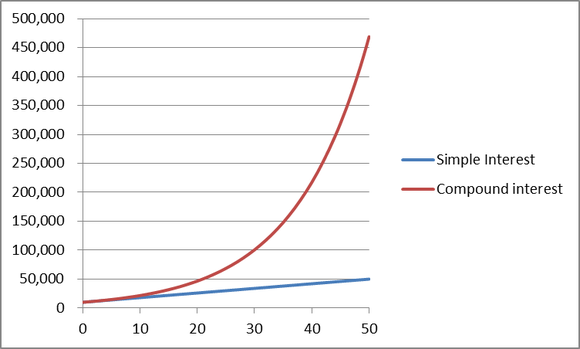

The Millionaire Next Door is a great weekend read. I highly recommend picking up a copy to read in more detail about the habits of the average Millionaire. As counterintuitive as it is, many Millionaires don’t spend on lavish vacations, buy luxury items, or drive the newest sports car. The Average Millionaire understands the importance of Compound Interest. When you create a budget, live within your means, and save at least 20% of your income, you can become the next Millionaire Next Door.